Update of the NOWPayments payment gateway

NodeJS, Koa, PostgreSQL

About the blockchain project

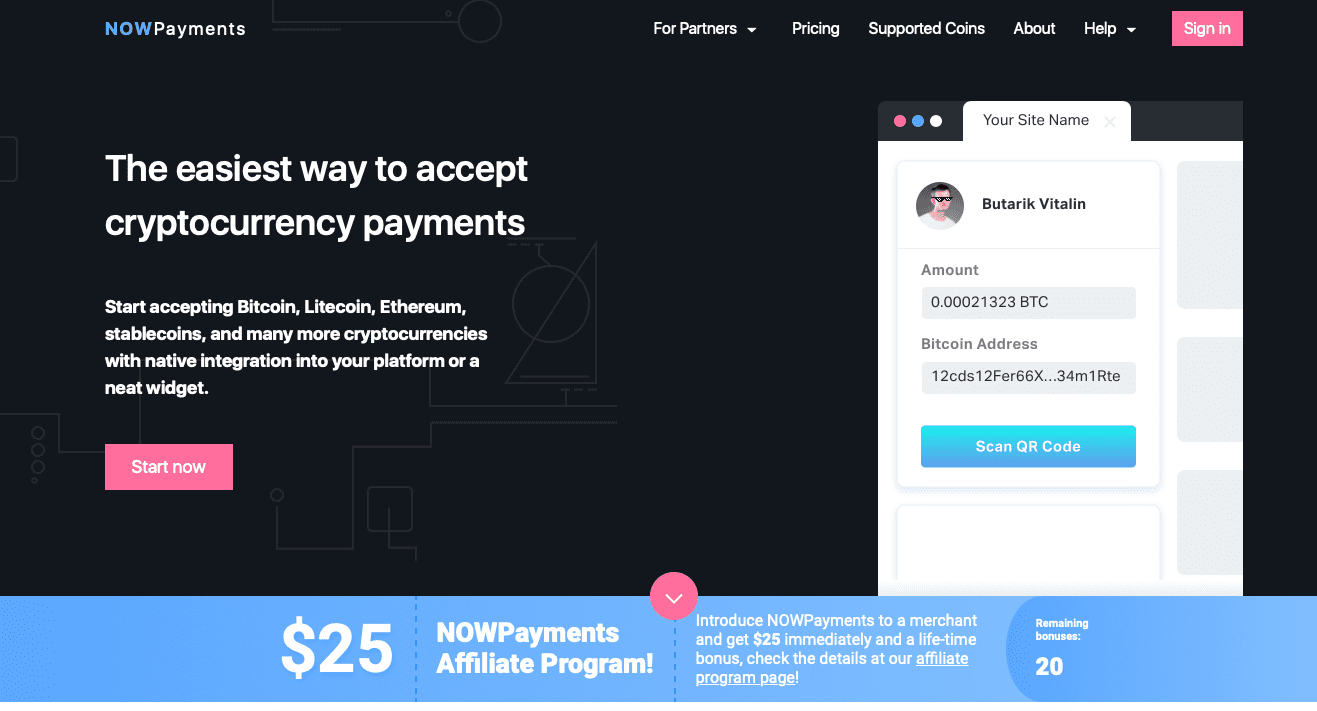

NowPayments (NP) is a payment gateway focused on cryptocurrency transactions with a fairly large flow of users. There are two sorts of them: merchants who use this gateway within their own stores and customers who buy something and pay. As you know, users are always preoccupied with the quality of service, especially in the financial sector. Therefore, NOWPayments decided that they needed to improve the quality of their service.

Blockchain project task

We had a clear goal — to make the NP service safer, more reliable and user-friendly. This work can be divided into two main blocks: the payment API and a merchant's account.

Blockchain solutions

Merchant's office

Let's start with the front end. We made it a little easier and clearer. We also made some changes to the content of the pages, added a footer and altered the colors. All these changes were not significant in terms of time spent. But they proved themselves to be significant in terms of profit.

We resolved the task of making the merchant office safer and more convenient to use. Thus, our team added:

-

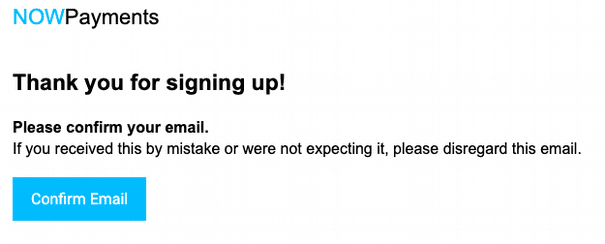

Two-factor registration via email (financial security is good)

-

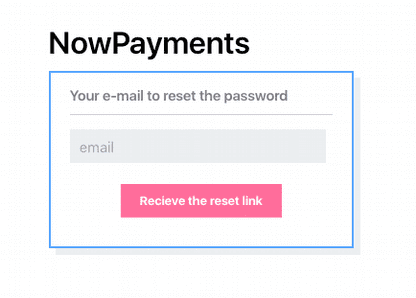

Capability to reset one’s password via email (this is really

convenient)

-

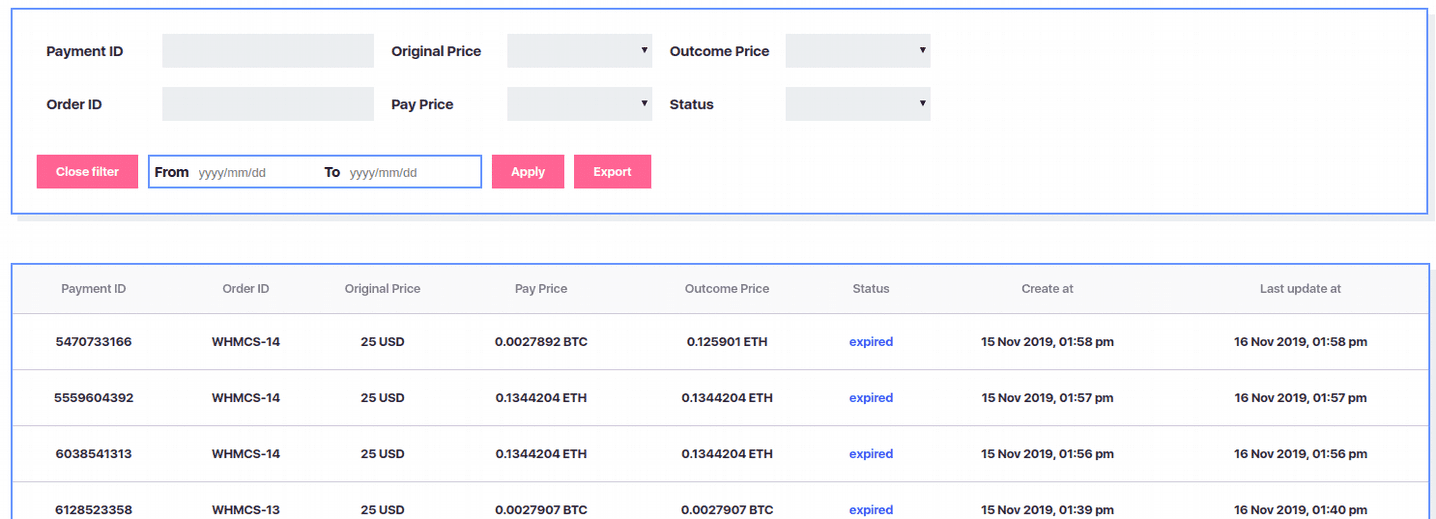

Filtering data in tables with payments

-

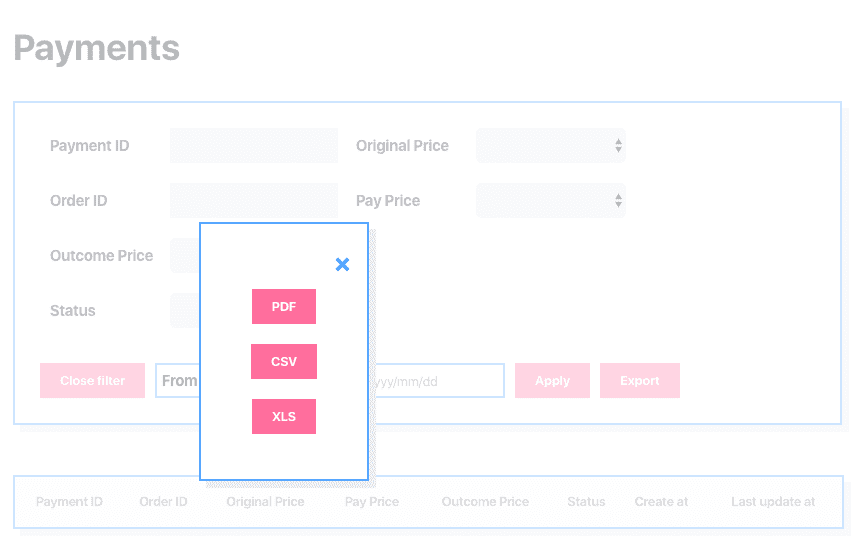

Uploading data from payment tables in various formats (PDF, CSV,

XLS)

- Receiving reports and statuses for operations by email

- Improved API key management

- Management of received coins, i.e. the merchant can determine the coins that he or she is willing to accept as payment

API

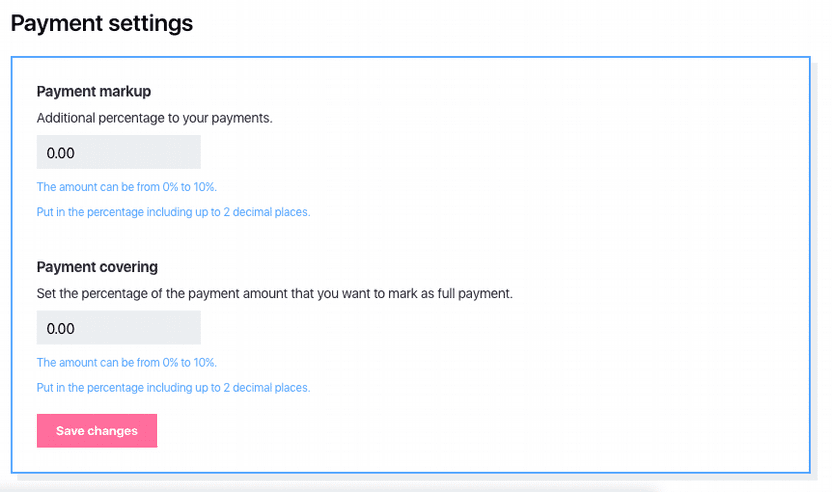

This is a truly interesting aspect. The original NowPayments team realized that merchants were different. Some of them, as true entrepreneurs, are ready to take risks and ‘play’ with prices. For them, a method was developed to level up their prices by invoicing additional % via a merchant's personal account. That is, the merchant can generate more profit by simply increasing his or her transaction fees.

Your message has been successfully sent.

Thank you for contacting Evercode Lab

We will get back to you shortly.